This article was written by Brandon Smith and originally published at Birch Gold Group

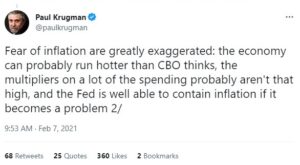

The one thing about the financial world that never ceases to amaze me is how far behind the curve mainstream economists always seem to be. Not long ago we had Janet Yellen and Paul Krugman, economists supposedly at the front of the pack, both proving to be utterly ignorant (or strategically dishonest) on the effects of central bank stimulus measures and the threat of inflation. In fact, they both consistently denied such a threat existed until they were crushed by the evidence.

This tends to be the modus operandi of top establishment analysts, and the majority of economists out there simply follow the lead of these gatekeepers – Maybe because they’re vying for a limited number of cushy positions in the field, or perhaps because they’re afraid that if they present a contradictory theory they’ll be ostracized. Economics is often absurdist in nature because Ivy League “experts” can be wrong time and time again and yet still keep their jobs and rise up through the ranks. It’s a bit like Hollywood in that way; they fail upwards.

In the meantime, alternative economists keep hitting the target with our observations and predictions, but we’ll never get job offers from establishment publications because they’re not looking for people who are right, they’re looking for people that toe the line.

And so it goes. I look forward to the fast approaching day when all of these guys (and girls) proclaim frantically that “no one saw this crisis coming.” After things get even worse, they’ll all come out and say they actually “saw the crisis coming and tried to warn us.”

The hope is not so much to get credit where credit is due (because that’s not going to happen), but to wake up as many people who will listen as possible to the dangers ahead, and maybe save a few lives or inspire a few rebels in the process. In the case of establishment yes-men, the hope is that they get that left hook to the face from reality and lose credibility in the eyes of the public. They deserve to go down with the ship – Either they are disinformation agents or they’re too ignorant to see the writing on the wall and should not have the jobs they have.

The latest US bank failures seem to be ringing their bell the past couple of months, that’s for sure. In a survey managed by the World Economic Forum, over 80% of chief economists now say that central banks “face a trade-off between managing inflation and maintaining financial sector stability.” They now warn that price pressures look likely to remain higher for longer and they predict a prolonged period of higher interest rates that will expose further frailties in the banking sector, potentially compromising the capacity of central banks to rein in inflation. This is a HUGE reversal from their original message of a magical soft landing.

Imagine that. The very thing alternative economists including myself have been “ranting” about for years, the very thing they used to say was “conspiracy theory” or Chicken Little doom mongering, is now accepted as fact by a majority of surveyed economists.

But where does this leave us? After acceptance usually comes panic.

The credit crunch is just beginning and the absorbing of the insolvent First Republic Bank into JP Morgan is a median step to a larger crash. The expectation is that the Federal Reserve will step in to dump more stimulus into the system to keep it afloat, but it’s too late. My position has always been that the central banks would deliberately initiate a liquidity crisis through steady interest rate hikes. This has now happened.

The Catch-22 scenario has been accomplished. Just like the lead up to the 2008 credit crisis, all the Fed needed to do was raise rates to around 5% to 6% and suddenly all systemic debt becomes untenable. Now it’s happening again and they KNEW it would happen again. Except this time, we have an extra $20 trillion in national debt, a banking network completely addicted to cheap fiat stimulus and an exponential stagflation problem.

If the Fed cuts rates prices will skyrocket even more. If they keep rates at current levels or raise them, more banks will implode. Most mainstream analysts will expect the Fed to go back to near-zero rates and QE in response, but even if they do (and I’m doubtful that they will) the outcome will not be what the “experts” expect. Some are realizing that QE is an impractical expectation and that inflation will annihilate the system just as fast as a credit crisis, but they are few and far between.

The World Economic Forum report for May outlines this dynamic to a point, but what it doesn’t mention is that there are extensive benefits attached to the coming crisis for the elites. For example, major banks like JP Morgan will be able to snatch up smaller failing banks for pennies on the dollar, just like they did during the Great Depression. And, globalist institutions like the WEF will get their “Great Reset,” which they hope will frighten the public into adopting even more financial centralization, social controls, digital currencies and a cashless society.

For the average concerned citizen out there, this narrative change matters because it’s a signal that things are about to get much worse. When the establishment itself is openly acknowledging that gravity exists and that we are falling instead of flying, it’s time to get ready and take cover. They never admit the truth unless the worst case scenario is right around the corner.

The “everything bubble” is nearing the end and retirement savers must take action! Why? Because inflation is eating away at your savings like a financial cancer with NO CURE! And the “everything bubble” could also tank your stock portfolio when it pops. So is there anything you can do? YES! A Gold IRA is the best move for retirement security. To see why, Click here to get a FREE info kit from Birch Gold Group about Gold IRAs. (This comes with NO obligation or strings attached.)

32 Comments

I am still trying to decide if a slow motion train wreck is better than a fast one. I currently have no debts but this mess we are heading into will destroy my retirement savings. No one will get through this without serious problems but we need to do what we can to prepare for the worst.

Organize as best you can with people of like mind. This will be the most important action you can take to prepare for the future.

Another Brillant article, Brandon!

…

“Not long ago we had both Janet Yellen and Paul Krugman, economists supposedly at the front of the pack, both proving to be utterly ignorant (or strategically dishonest) on the effects of central bank stimulus measures and the threat of inflation.”. To my mind, they are strategically dishonest; CLEARLY!

As I read your post, I have in mind specifically 2 of your previous articles: “The worst thing is that central bankers know exactly what they are doing”(published in 2015), and this one: “Explanations on the end of the economic game”(2014).

Here’s we are!

…

So, for your attentive readers, we should be not surprised by what is currently going on about the global economy and the misinformation and “U-turns” of the globalist elites and MSM “experts” such as Yellen, Krugman and Co.

…

PS: I remind that in the cover of the annual special edition of “The Economist” entitled “The World Ahead 2022”, 3 main dates are mentioned: 2021, 2022 and 2023.

In the last cover of the annual special edition of the Economist: “The World ahead 2023”, no mention of the economy…

Brilliantly analyzed the mathematical contraint problem by Brandon Smith.

Likewise, I have been warning family and friends since 2003 (after reading Richard Duncan’s “The Dollar Crisis”), that we are headed for the Greatest Economic Depression in the history of mankind.

I thought 2008 was going to be it, but no one had imagined the central banks could print $29 – $35 trillion to delay the inevitable.

There is benefit to alternative research and warning others. That is you become more convinced to prepare harder to avoid the techno-gulab by becoming more resilient. Thank God Almighty for the extra time we were given.

Finally Realizing? You mean establishment economists who got well paid for maintaining government lies and propping up the fraudulent thieving economic system are now “realizing” that they are going to continue to get well paid to do the same thing? And suffer no consequences whatsoever for their lying and damaging others?

You mean those establishment economists?

Nobody gets anywhere in this system for telling the truth, everyone knows that. So it’s long past time to pretend.

Well, yes, that’s exactly what I said in the article.

Time to take cover and brace for impact indeed! I’ve had this time of the year marked on my calendar for almost a year…ever since the Fed announced that it would have it’s FedNow CBDC ready by July 2023. We’re now just 2 months away, meaning that there’s a high chance that the financial crash will happen before July so they can create their reasons why a CBDC would be needed. If you have savings, and don’t have some of it invested in precious metals, then you should get in ASAP!

I have 100% of my savings in silver. I call that my hard savings. Every time the price goes up a dollar my savings increases by several hundred dollars. As more banks collapse, I have more wealth to help me rebuild on the other side of what is coming.

I don’t expect it will do a lot of good during the upcoming tragedy because there will be scant little to buy with it even if I wanted to. But if a good deal comes along I will at least have the resources to take advantage.

And here’s how THEY’LL justify the digital currency…they intentionally cause a bank run by passing a rule / law prohibiting the transfer of money, fully knowing that people will therefore rush to the exits before they’re shut out of their accounts. https://www.youtube.com/watch?v=NZudbD0Y_HM&ab_channel=ArcadiaEconomics

“… how far behind the curve mainstream economists always seem to be.”

.

We live in World where economies are totally manipulated. That means, someone somewhere is writing a financial and economic script to follow. Mainstream economists get and keep their jobs by sticking to The Script and spreading the stories of those conjured narratives. Some of these ‘economists’ are dumb as rocks and just keep peddling what they are paid to peddle. Others have a bit more upstairs but that doesn’t matter because they are not allowed to venture off of the authorized narrative farm and so they keep their wisdom (such as it is) to themselves.

.

The big fact today is how amazing it is that these Financial Conjurers have kept this lead balloon of an economy aloft for so long. Nobody expected this House of Cards to keep percolating along as long as it has. And because They have been able to do that kind of bizarre magic… one must give them a bit of a tip-of-the-hat while also cursing Their unhealthy dominance and control of All Things World Finances.

.

Who knew that money conjured out of thin and magically pulled out of a big hat (like the white rabbit in the Magician’s Magic Act) could last so long and keep the entire World running for decades. Sort of like trying to fill your gas tank with fake gas but amazingly the car is actually running on the damn stuff.

.

“… this narrative change matters because it’s a signal that things are about to get much worse.”

.

Much of the World will not know how to cope when the Lead Balloon finally flops to the ground. Many will look to the very same Financial Conjurers to save them… not realizing that it was those very same Conjurers that created the entire dark predicament that the World now faces.

.

In Life, when someone is ‘Doing You In’… it’s usually not your best option to go right back to them and ask for their help. And that is a big lesson the World is going to learn next.

Or not learn yet again. Every dying empire has done the same thing for thousands of years and the people never seem to learn.

@Fink Ployd, I would say the majority of the people simply DON’T WANT to learn as learning entails having to be fiscally responsible within your means, and not spending every last dime on entertainment for today.

Many people have competely lost the ability to think and reason and assess and comprehend. They have become nothing but Receiver-Sponges of damaging material prepared and dished out to them on State Media and Anti-Social Media. Just a bunch of verbal and intellectual sewage collecting in their brain matter and sapping them of their personal independence and life vitality.

.

Look at most people when they stare at the small Magic Box of Dancing Pixels. Usually a blank and empty look on their faces. Low-level mental processing while their emotions are being deliberately hijacked and manipulated. With the occasional smile as they look at some kind of nonsense video designed to keep their brains on full idle.

.

Trying to get people like that to become cognizant of the existential peril we are in today is a hopeless task. A light might dimly be on in their ‘upstairs room’… but there is no one left at home up there anymore.

.

And certainly no one around to sweep out the big mess up there.

About regional banks, the massacre continues!

PacWest Bank is in very serious trouble.

https://www.youtube.com/watch?v=cd19IWCnRxs

Considering these other threats: inflation, severe drought in the agricultural belt(in US, but not only), recession, food shortages, diesel fuel and heating oil shortages… a “perfect storm” is brewing in the United States and around the world.

…

PS:

“The credit crunch is just beginning and the absorbing of the insolvent First Republic Bank into JP Morgan is a median step to a larger crash.”

The same move happened between UBS and Credit Suisse in Switzerland in order “to save” swiss banking (and avoid a worldwide contagion).

We see the result.

Great article Brandon, I think we all know this whole crisis has been manufactured to introduce their CBDC (social credit system), covid and the accompanying disability shots were used to create the reason to print money that would break the system (the problem), everybody will in fear of losing their savings, assets, business etc (the reaction), but then they will bring out their salvation their CBDC (the solution), the question is how many of us will stand strong when they offer their compensation in the form of CBDC that their big business will be accepting , CBDC’s for lost 401K’s, you lost your job? Not to worry you can sign up for CBDC and receive UBI, have a mortgage you can’t afford because of sky rocketing interest rates ? Not to worry sign up to the CBDC and your mortgage debt will be forgiven, can’t afford you groceries because of skyrocketing inflation? Not to worry sign up to CBDC and you will receive digital vouches to buy your groceries. Personally, I think majority of people will fold and sign up just like they lined up for their Jonestown shots

Alex, in general, I agree with your thoughts. But they won’t forgive mortgage debt. Rather, they’ll say, “Can’t pay? No problem, we won’t hold the debt against you as long as you just give up your right to ever own any and all property.” And they may even require you to take the jab as part of this program. Simple.

Alex and Gunatelete, good points that you have touched.

In Spain, the principle of the loss of the right to private property has its agenda, which can already be seen clearly.

There are many people who renounce the inheritance due to the very high processing costs.

On the other hand, the ILLEGAL OCCUPATION of your home is allowed. For example, you go on vacation and when you return your home is occupied by people you have no idea who they are, they waste electricity, water and you have to pay everything, plus the mortgage…

If it is your usual home, your first home, there are more possibilities for the police to intervene, but if it is your second home, things get difficult, the process to get them out can take years.

If you want to “occupy” your house (remove the squatters and you have reported it before) the police intervene to protect the squatter and it is your fault, there are legal consequences.

If the squatter leaves and another squatter comes, nothing happens (“it’s legal”) the police do nothing.

The norm is that he occupies, after entering YOUR HOUSE, calls the police and tells them that he has occupied such a house on X street, number Y, and from this moment he has a certain right to be in your house.

Good article.

I’m finding that many do not attribute inflation to increasing money supply/fiscal stimulus/overspending, but rather to price gouging. One claim I’ve seen is that certain key groups expected inflation, both post QE and covid, so it became self-fulfilling. I.e. various sectors were able to massively raise prices while making record profits.

What are your thoughts? How does one demostrate objectively the cause and effect, rather than it simply being correlated? It’s easy to show for asset-price inflation, but less the CPI/RPI.etc

The only people trying to make the “price gouging” claim are in the leftist corporate media. It’s an attempt to divert blame away from government and central banks over to the “free market”, which doesn’t exist anymore in the west. All one has to do to prove that this is nonsense is to show the price spikes in raw materials and production costs. All companies are paying more for their materials, labor and manufacturing, thus their product prices also go up. Only a handful are actually making greater profits, like the oil industry, but this is more because of currency conversions due to oil being priced in dollars globally. Remove the petrodollar and oil prices will skyrocket even further while companies make less and less profit.

Isn’t this just them killing two birds with one stone? They get the inflation they’ve always wanted, and in the process of attempting to “constrain it,” they’re killing off small competitor banks (and thus many small businesses).

Put it together with 2008, QE, and the COVID mania, and it starts to look like a long game toward serfdom that’s delivering everything they’ve sought after for decades—centuries, really.

It’s more like they are killing one bird with two stones – Inflation or deflation, either way they get the crisis they want.

Well written, Brandon. I agree completely with every word and every feeling. It is exactly how it goes and predictably how it will go. You nailed it.

Thanks for the Birch Group recommendation. Just rolled it all over and into the Texas vault. They could not have made it easier. Not perfect but, far better.

–There’s one wild card IMO. The importance of much of the world shifting away from the US/West dominated one. Its really had to quantify as well so best to watch behavior. Rubio whining about economic sanctions no longer mattering is a sign some of them are worried. The insane push to support Nazis in Ukraine is another.

–Got a laugh out of the Mexican Pres AMLO. Even though he’s a Socialist or whatever I believe him to be a good dude. Personally I more vested in truth tellers these days. He’s opening up the floodgates and telling them to all vote Democrat. Hey all you can do is laugh sometimes. To my understanding this guy was partially assisting the Trump admins border plans. IMO AMLO knows we are on a highway to hell so best let us have our death wish. I don’t believe the Mexican Govt controls the cartels; ours does. Just another proxy to spread instability.

–Truth is the USA can be stupid, lazy, arrogant just like the economists you mention and we will never get our comeuppance. However, there is one caveat, we must ensure everyone is else is even more so. I suspect they’re catching on.

Hi Brandon, great analysis (as always). Question: Do you think that the US will fail to raise the debt ceiling this time round and default on it’s debt?

I have mixed feelings on that situation. You can read my recent article on it here:

https://alt-market.us/blaming-conservatives-for-collapse-damned-if-they-do-damned-if-they-dont-on-the-debt-ceiling/

I think this is a perfect opportunity for the establishment to force an impasse and then blame conservatives for the crash, but it would require Democrats to refuse any and all budget cuts and leave Republicans that actually care about the debt ceiling no other choice but to block a ceiling increase.

Hey Brandon, thanks for this article, and I share your concerns. In gold we trust!

This time its different. I’ve heard that my whole life. Only this time it rally does seem different. I know that sounds dumb, right? Cant help but feel the introduction of the CBDC is potentially the straw that’ll break the camels back.

Judging from how many lined up for th Orange goo, makes me think this coming digital Gulag will be resisted by 5-10% of people, tops. It would be better if it was more, but you go to war with the Army you have, not the one you wish you had

More like 30% or more looking at the level of resistance to the covid vaccine mandates. That’s why they gave up on the passports they knew our numbers were too large.

The uptake on the shots was 65-80% depending on who you believe. GovCo stats would tend to overstate their numbers so you’re probably right. I just have a hard time believing when push comes to shove that most wont fold.

Still a fabulous time to be alive and have the opportunity to aaquit ourselves well in the eyes of our ancestors. I’ll be honored to stand in the company of so many true Americans, even if its 10%. I can still remember 30 years ago or more when it was only 2-3%.

Time does work to our advantage, the longer the lights stay on, the more people come over to the light. TPTB have only darkness, debt, death and debauchery to offer.

Great interview of Rafi Farber on the US Dollar, Banking Crisis and Precious Metals, IMF Unicoin, Sound Money and Non-Compliance, etc. https://www.youtube.com/watch?v=8Nvy20ivqUA

The IMF’s chief economist said Tuesday that Europe is “vulnerable” even though its banks appear “solid.”…No kidding!?

I still think that EuroZone is going to collapse first.

To watch – among others – these folowing european banks “too big to fail”: UniCredit(Italy), Societe Generale(France) and Deutsche Bank(Germany).

https://www.youtube.com/watch?v=sE3u5V2p4xo

This summer could be like the summer of 2008, only worse.

…

Still on the topic of the CBDC, here is a speech by former IMF Head Christine Lagarde, which you mentioned in one of your previous articles a few years ago:

https://www.imf.org/en/News/Articles/2018/11/13/sp111418-winds-of-change-the-case-for-new-digital-currency